It is very well known that most people enjoy being around like-minded individuals. It provides common ground, shared interests, and a basis for expected values. This holds true in general peer-to-peer relationships as well as in business relationships.

As a Christian, it is great to be afforded the opportunity to find companies that have the same values as you. In some instances, it just doesn’t make sense to seek out a Christian company. Though it is always great to support a Christian company, whether or not the company who makes your coffee table claims to be a Christian company is not going to have much of an impact on your experience as a consumer. Other times though, it can totally transform your experience.

Here are 4 instances where seeking a Christian company makes sense.

Christian Daycare

Where you send your young children to school is a huge decision. These are the folks who are going to be giving your child their first regular social interactions. It is great to know that not only do the teachers/caretakers have similar beliefs and values to you, but the other children are probably being raised in a similar manner to yours.

Christian Counseling Services

Life get’s tough, and sometimes it is helpful to seek professional counseling to help us navigate those difficulties. For Christians, it can be incredibly helpful if the person who is helping you try to find the needed direction in your life is also seeking His guidance. Having biblical references accompany clinical suggestions can make the appointments doubly effective.

Christian Real Estate Agent

Christian Real Estate Agent

Buying a home is a huge deal, and while this one may not hold quite as much weight as the others, it can be very helpful to work with a Christian Real Estate Agent. For most people, their home will be the biggest purchase they make in their lifetime. It gives a great deal of peace of mind to know that you are working with someone who lives their life in accordance with Christian principals.

Christian Debt Relief Company

If you are struggling with your finances, a Christian Debt Relief company can help you to put you on track to reach your financial goals. Many debt relief programs are long-term and often last 3-7 years. Since you will be working so closely with the company and it’s financial advisors, it is very helpful for them to share your values and principles. Plus, handling your finances according to Biblical principals– such as including a tithe in your budget– is not always in line with suggestions made by non-Christian companies. When working with a Christian company you know that your counselor not only understands where you are coming from but even approves of it!

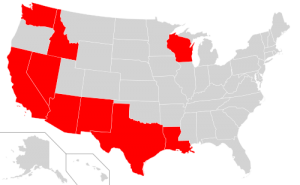

While we cannot help you with the first three, if you are in need of financial guidance and would like to work with a Christian company, please take a moment to speak with one of our Advisors for a free consultation.

Seeking out a Christian company does not always make sense in todays world. The more important the decision is though, the bigger of a factor it becomes.

While your basic philosophies on finances may already be well known to each other, one thing that may often be overlooked is how your credit report is going to be affected. It is incredibly important that among all of the other conversations that you are having while planning your marriage, that your credit and debt be a huge topic of discussion. After all, finances tend to be one of the most common sources of difficulties in marriage. For that reason, we suggest that you get a good grasp on your combined situation as soon as possible.

While your basic philosophies on finances may already be well known to each other, one thing that may often be overlooked is how your credit report is going to be affected. It is incredibly important that among all of the other conversations that you are having while planning your marriage, that your credit and debt be a huge topic of discussion. After all, finances tend to be one of the most common sources of difficulties in marriage. For that reason, we suggest that you get a good grasp on your combined situation as soon as possible.