As someone who chooses to live out their Christian faith, it feels good to connect with companies that share in those personal values. It provides instant common ground, shared interests, and a baseline for expected values.

Let’s be real, though.

Sometimes that claim is nothing more than a marketing ploy at best… and an outright trap at worst.

Other times, though, it can totally transform your experience.

Thankfully, God gives us the gift of discernment to recognize a scam. We always encourage prayer and discernment accompany any important decisions.

Here are 4 instances where seeking a Christian company could make sense.

Christian Daycare

Where you send your young children to school is a huge decision. These are the folks who will give your child their first regular social interactions. It is great to know that not only do the teachers/caretakers share your beliefs and values, but the other children are probably being raised in a similar manner to yours.

Christian Counseling Services

Life get’s tough, and sometimes it is helpful to seek professional counseling to help us navigate those difficulties. For Christians, it can be incredibly helpful if the person who is helping you try to find the needed direction in your life is also seeking His guidance. Having biblical references accompany clinical suggestions can make the appointments doubly effective.

Christian Real Estate Agent

Buying a home is a huge deal, and while this one may not hold quite as much weight as some others, it can be helpful to work with a Christian Real Estate Agent. For most people, their home will be the biggest purchase they make in their lifetime. It gives a great deal of peace of mind to know that you are working with someone who lives their life in accordance with Christian principles.

Christian Debt Relief Company

If you are struggling with your finances, a Christian Debt Relief company can help you to put you on track to reach your financial goals. Many debt relief programs are long-term, lasting 3-5 years. Since you will be working so closely with the company and their support team, it is very helpful for them to share your values and principles.

Plus, handling your finances according to Biblical principals– such as including a tithe in your budget– is not always in line with suggestions made by traditional secular companies. When working with a Christian company, you know that your counselor understands and appreciates the deeper elements of your experience.

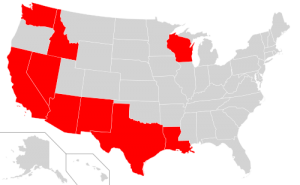

If you need a plan to deal with debt, FaithWorks Financial is a team of Christian financial counselors here to guide you on your way. Schedule a call and speak with one of our Advisors for a free consultation.

While your basic philosophies on finances may already be well known to each other, one thing that may often be overlooked is how your credit report is going to be affected. It is incredibly important that among all of the other conversations that you are having while planning your marriage, that your credit and debt be a huge topic of discussion. After all, finances tend to be one of the most common sources of difficulties in marriage. For that reason, we suggest that you get a good grasp on your combined situation as soon as possible.

While your basic philosophies on finances may already be well known to each other, one thing that may often be overlooked is how your credit report is going to be affected. It is incredibly important that among all of the other conversations that you are having while planning your marriage, that your credit and debt be a huge topic of discussion. After all, finances tend to be one of the most common sources of difficulties in marriage. For that reason, we suggest that you get a good grasp on your combined situation as soon as possible.